A credit for a specific foreign tax for which foreign tax credit would not be allowed by the Internal Revenue Code. The organization may have applied to the IRS for recognition of exemption and been recognized by the IRS as tax-exempt after its effective date of automatic revocation.

Dlocal Local Payments Made Easy In Asia Africa And Latin America

Installment installment 122995 USD.

. E-Filing of 2550M VAT for December 2021 Group E. 1 Pay income tax via FPX Services. Malaysia has imposed capital gain tax on share options and share purchase plan received by employee starting year 2007.

Price price 000 USD. The FPX Financial Process Exchange gateway allows you to pay your income tax online in Malaysia. Study from 1992.

This is majorly in line with the pre-GST regime. Computation of capital allowances. An installment sale under Section 453 involves a disposition of property where at least one payment is received by the seller after the tax year in which the disposition occurs.

These costs include such expenses as bookkeeping reporting calculating and remitting tax payments. Advance tax payments done until 31st March of the year should be 100 of your total tax payable. Here are the many ways you can pay for your personal income tax in Malaysia.

Mastercard MA and Pine Labs launch an installment program in the Philippines so that customers can opt for interest-free installment payments using ones credit card subject to certain conditions. Title title Google Pixel 3 - 32 GB - Midnight Blue with 12 monthly payments. To check whether an organization is currently recognized by the IRS as tax-exempt call Customer Account Services at 877 829-5500 toll-free number.

Year of Assessment 2014 RM QE 110300 Deposit 15000. Google product category google_product_category. The best would be via the IRBs own online platform ByrHASILIts the only online platform that supports payment by credit cards Visa Mastercard and American Express so you can earn some points or cashback for paying income tax just note that there is a processing.

This table lists the income tax and withholding rates on income other than for personal service income including rates for interest dividends royalties pensions and annuities and social security payments. The participating banks are as follows. You must also file Form 8833 if you receive payments or income items totaling more than 100000 and you determine your country of residence under a treaty and not under the rules for determining alien tax status.

The installment method of reporting is mandatory in the case of an installment sale. Tax Rates on Income Other Than Personal Service Income Under Chapter 3 Internal Revenue Code and Income Tax Treaties Rev. Income taxes in the United States are imposed by the federal government and most statesThe income taxes are determined by applying a tax rate which may increase as income increases to taxable income which is the total income less allowable deductionsIncome is broadly defined.

Capital expenditure for the installment payments 95300 Hire purchase interest RM9600 48 RM200 per month Monthly installment RM95300 48 RM1985 for 47 installments. CRT installment sale private annuity trust a 1031 exchange or an opportunity zone. To check whether an organization is currently recognized by the IRS as tax-exempt call Customer Account Services at 877 829-5500 toll-free number.

The tax to be paid on the final product is INR 450. Section 234B applies when Advance Tax has not been paid and since Advance Tax is payable as per dates set out by the IT Department 234C is applicable when interest is not paid according to these due dates. By far online payment is the easiest and most efficient way to pay income tax in Malaysia.

Tax Credit is the backbone of GST and for registered persons is a major matter of concern. However a taxpayer may elect out of the installment method. You can read in detail about 234B and 234C.

Renewal of mayors permit and payment of local taxes for YE 2022 or payment of 1st installment of local taxes. Product data for a midnight blue Google Pixel 3 - 32MB phone priced at 000 USD with 12 monthly installment payments. And RM2005 for the last In installment.

This calendar lists all important payments and registration schedules from the BIR SEC and other agencies. Say for instance that you are a manufacturer. The purchase tax paid is INR 300.

These rules are quite stringent and particular in their approach. A couple could shield nearly 24 million from federal estate and gift tax in 2021 compared to just 10 million in 2011 4 million in 2008 and 2 million 2003. Individuals and corporations are directly taxable and estates and trusts may be taxable on.

The organization may have applied to the IRS for recognition of exemption and been recognized by the IRS as tax-exempt after its effective date of automatic revocation. First of all you need an Internet banking account with the FPX participating bank.

Connect To A Payment Gateway Webflow University

Payment Methods Available For Teams

Taxplanning Tax Measures Announced During The Mco The Edge Markets

Advance Payment Invoice Template 9 Free Docs Xlsx Pdf Invoice Template Invoicing Advance Payment

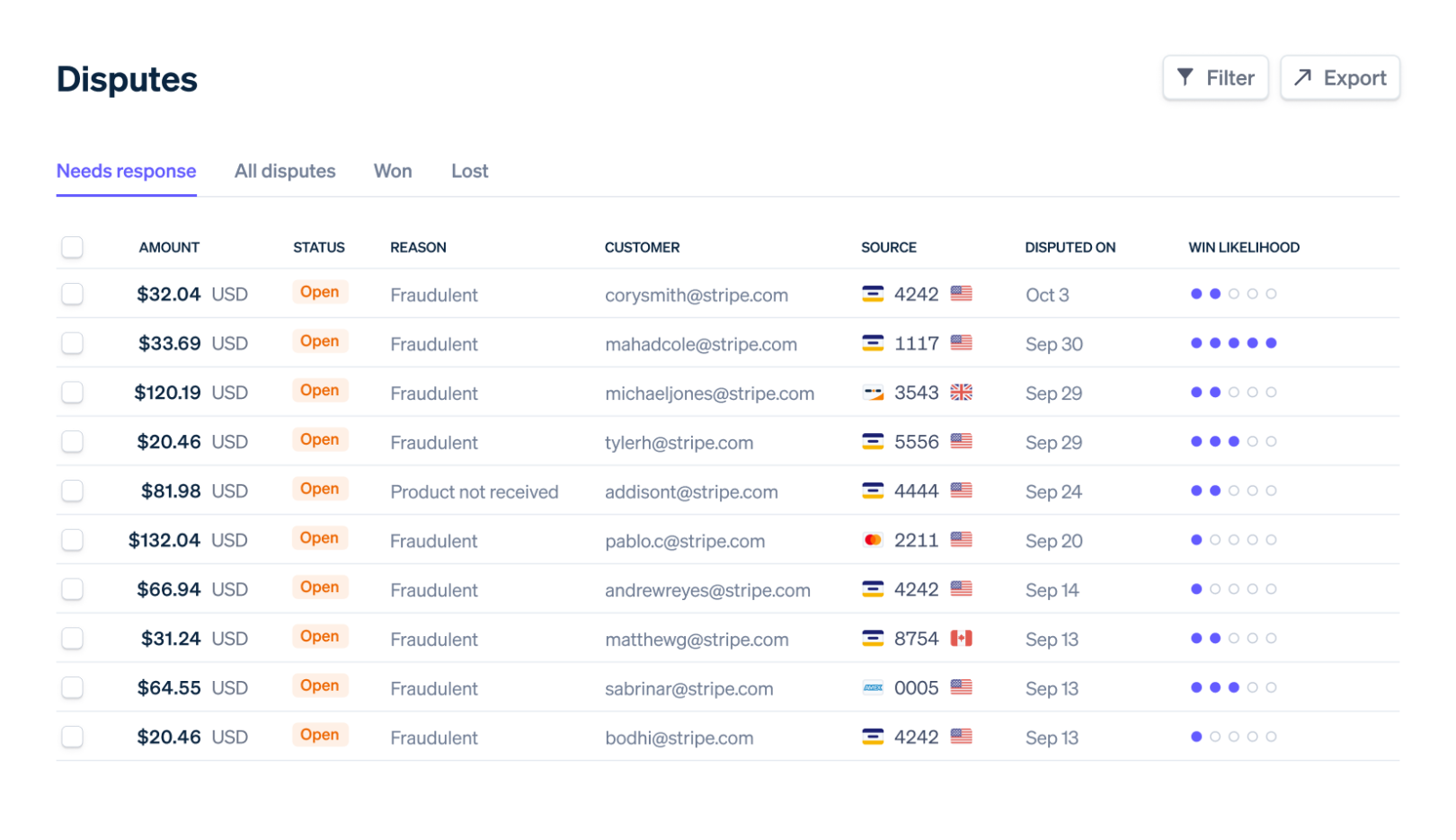

Stripe Chargeback Protection Prevent Chargeback Disputes

Maulid Dan Daurah 40 Malam Sandakan Malaysia 2015 2016 Malam

How Can I Pay For My Purchase On G2a Com Support Hub G2a Com

Global Payments 2021 All In For Growth Bcg

4 No Interest Payments With Sezzle Buy Now Pay Later

Introducing The Payment Element

Dlocal Local Payments Made Easy In Asia Africa And Latin America

How Can I Pay For My Purchase On G2a Com Support Hub G2a Com

Public Bank Berhad Lhdn Income Tax And Pcb Payment

How To Pay Your Income Tax In Malaysia

Eft Nedir Nasil Yapilir Blog Seyahat Para

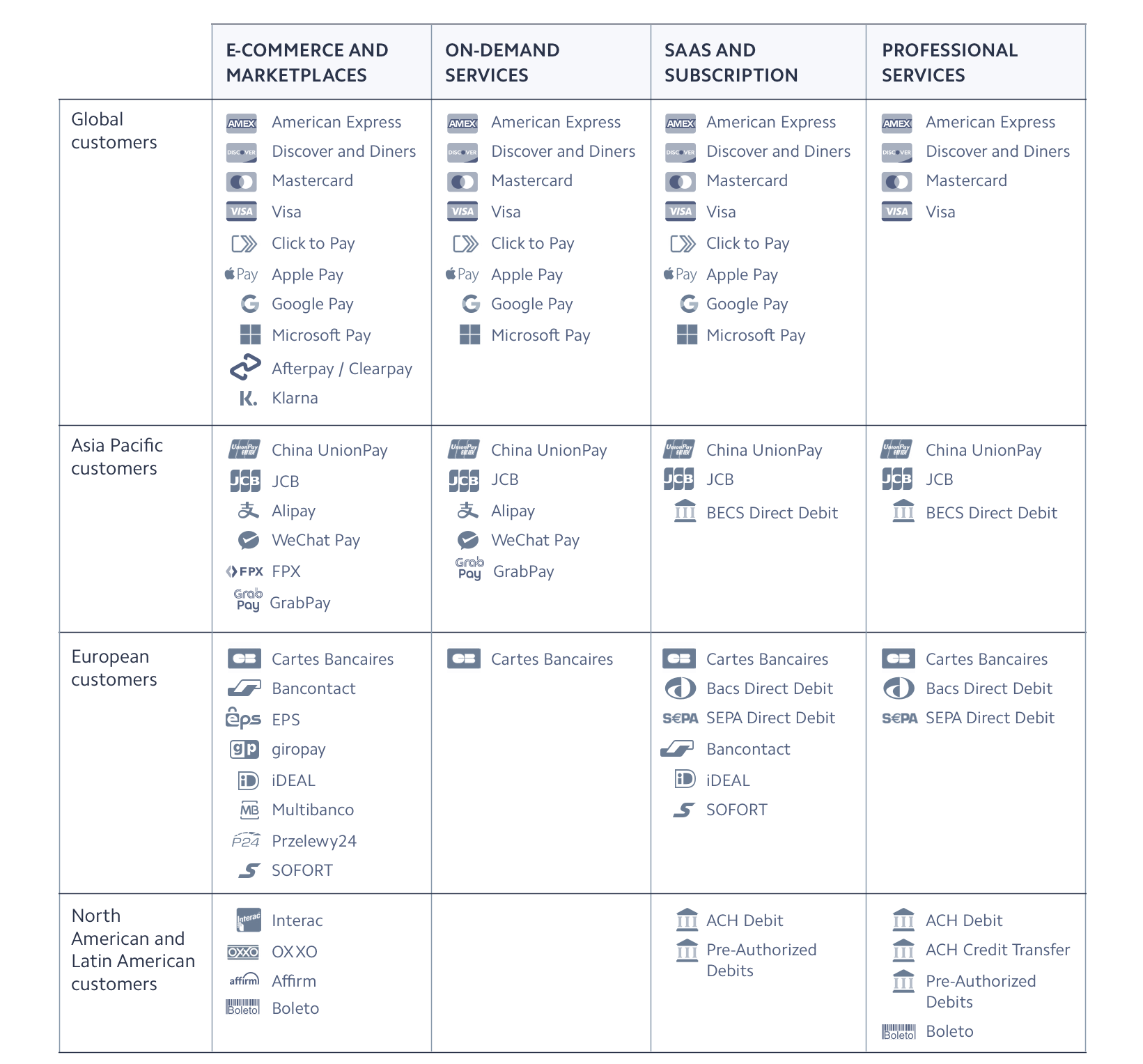

Stripe A Guide To Payment Methods